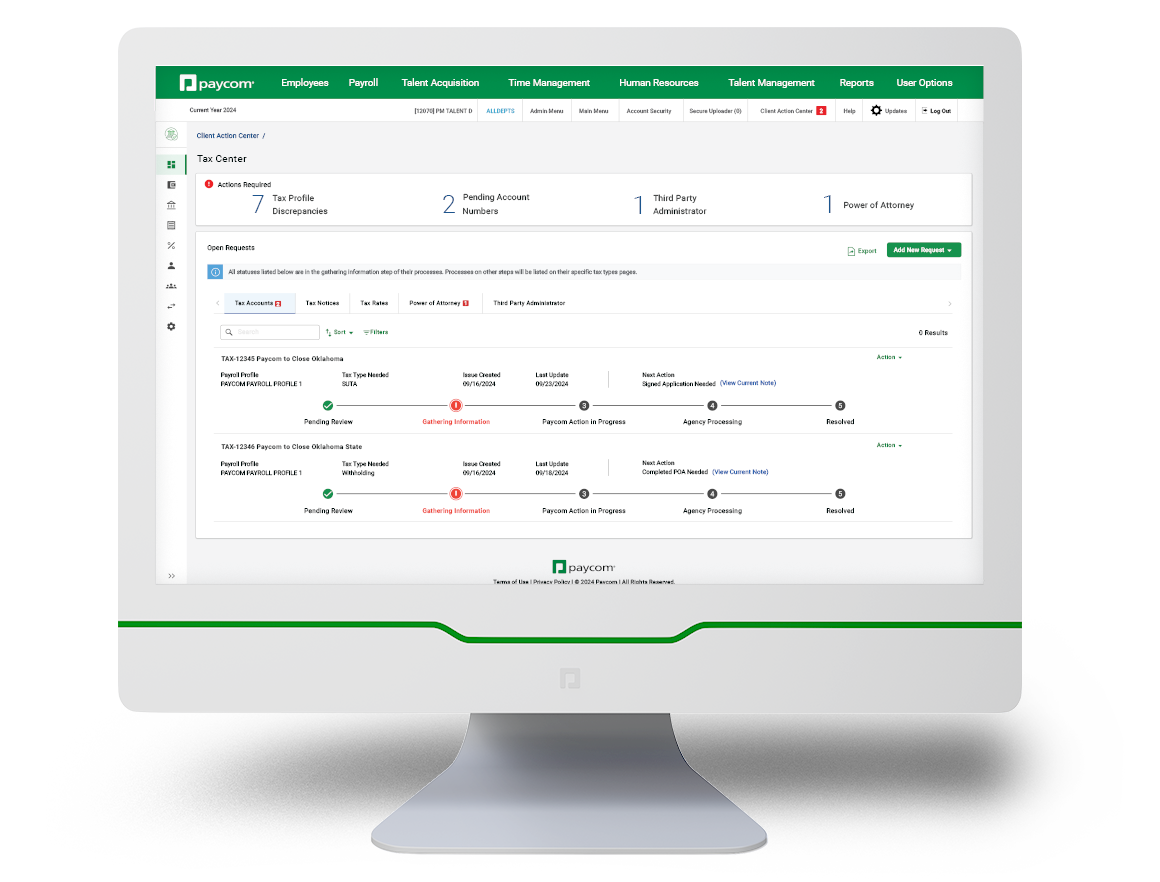

Client Action Center

Resolve your tax and banking-related requests in an easy-to-use dashboard

What it does

Your tax and banking needs in one place

Tired of hopping across systems to access your company’s tax info and wire transfers? What about calling support for basic updates? Help yourself by cutting out the middleman. With our Client Action Center, you’ll enjoy a self-service experience that lets you easily see, manage and resolve tax and banking issues — all in Paycom’s truly single software. Plus, our tech automatically notifies you about taxes and wires that require attention, so you stay ahead of prior period adjustments.

Client Action Center lets you easily:

- track the status of open issues

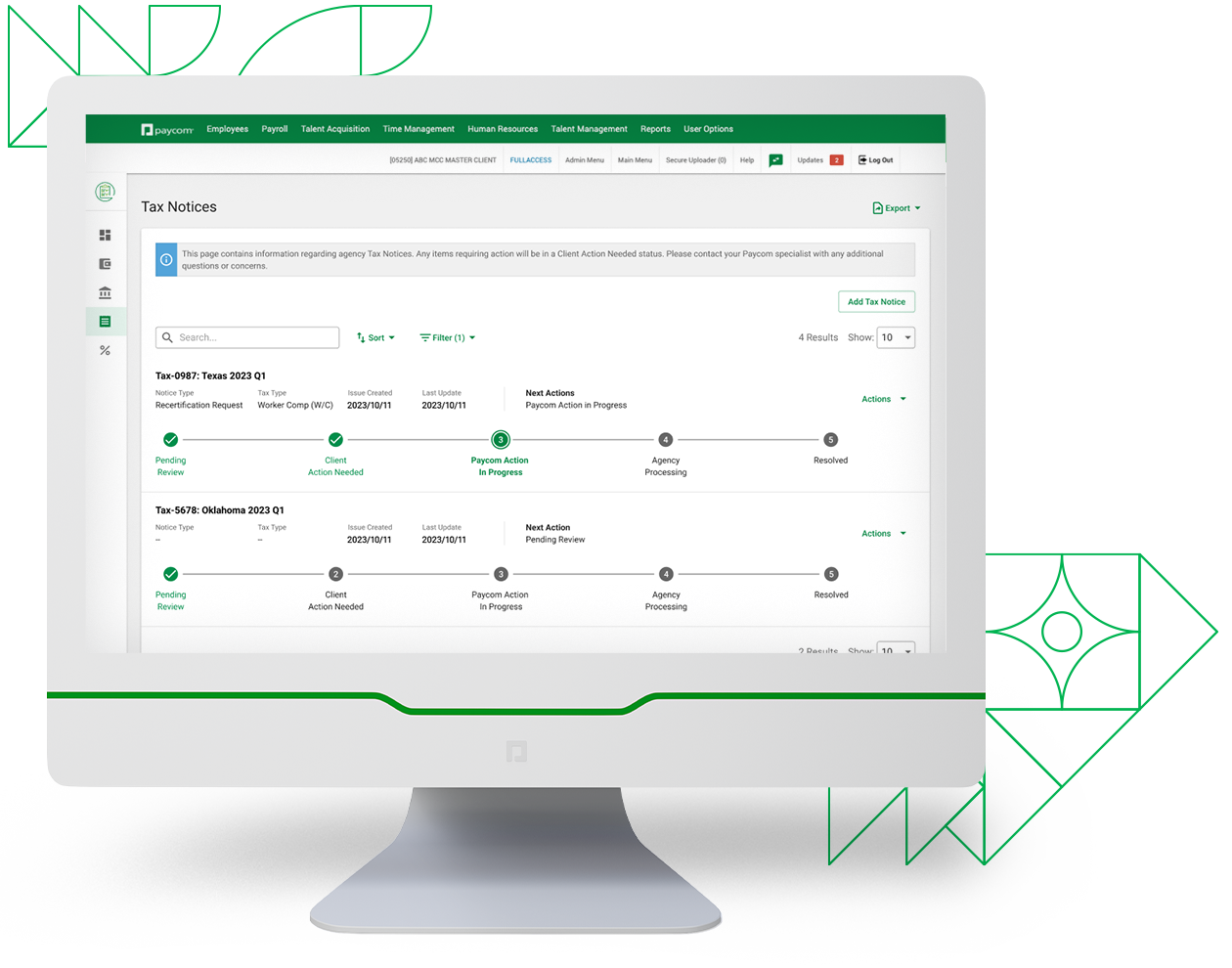

- upload, access, track and respond to action items for tax agency notices

- view pending and missing account numbers

- review and update employee tax profile discrepancies

- gauge rates, status and frequency of accounts for SUTA, disability and paid family leave

- see the real-time funding status, reception and location of regular and drawdown wires

- add and update tax account information, including rates, tax IDs and supporting documentation

Why it matters

Because you thrive when you’re proactive

It gets stressful spinning so many plates. Especially when those plates carry the risk of fines, audits and other noncompliance penalties. Client Action Center helps you stay on top of key deadlines and potential issues.

Intuitive dashboard

Behind your desk, during meetings or out in the field, Client Action Center’s dashboard helps you make informed, accurate decisions from anywhere.

World-class service

If you have any questions about payroll taxes, you can call your dedicated Paycom specialist — or their supervisor — with just one tap.

Adjust with confidence

Say goodbye to frustrating corrections. Client Action Center gives you early visibility into payroll tax issues that need attention, so you can easily address prior period adjustments.

Timely tax rates

Tired of stressing over every tax rate affecting your business? Client Action Center keeps track of local, state and federal tax rates, giving you real-time insight.

Full-solution automation

The easiest way to manage taxes and banking

How much more strategic could you be without your most tedious work? You’ll find the answer in no time using Client Action Center. While we automate what you used to do manually, you can focus on big-picture strategy.

Client Action Center automates

Wire transfers

Funding and banking info related to your wire transfers appears in real time.

Tax notices

Any tax agency notice you upload for research and resolution automatically flows to our tax specialists.

Tax registration

Data flows seamlessly from your requests directly to our tax specialist team. Plus, they’ll register your company’s taxes for you.

Tax profile info

Important details about relevant tax entities — like an employee’s lives-in state, works-in state and SUI agency — autopopulate in Client Action Center.

Employee data

Once your employees enter their name, home and work location address, that info automatically flows into Client Action Center.

Call requests

Whenever you request a call from your Paycom specialist using our mobile app, it automatically creates and assigns a task for them to quickly and effectively serve you.

See what people are saying about Client Action Center

Client Action Center seamlessly connects with

While Client Action Center provides you with key details, our tax management service simplifies filing and paying your organization’s payroll taxes.

Beti®

Our self-service payroll experience automatically identifies errors before submission, including possible tax rate issues.

Any tax-related info your people enter into our intuitive self-service software flows seamlessly into Client Action Center, so you don’t have to dig for it.

Frequently asked questions

Learn more about our self-service tax and banking software

Client Action Center is a Paycom tool that allows you to easily manage tax- and banking-related matters through an intuitive dashboard. Best of all, this tech exists in our truly single software, which means any relevant tax data your employees enter flows straight to Client Action Center without any data reentry.

Plus, Client Action Center automatically notifies you about taxes and wires that require your attention, so you have a proactive advantage in addressing possible issues. This tool also simplifies contacting your dedicated Paycom specialist by allowing you to reach them — or their supervisor — with just one tap.

Client Action Center helps with tax management by automatically tracking local, state and federal tax rates. Additionally, the tech notifies you of potential tax issues early, so you can address them before they impact your business. Client Action Center’s dashboard also lets you easily add, update and track important tax information and agency notices.

Yes! Paycom’s Client Action Center gives you instant access to tax and banking data no matter where you are. And should you ever have a question, you can quickly contact your dedicated specialist right from our mobile app.

Yes! Client Action Center automatically notifies you about payroll tax issues that require attention, so you don’t have to guess if your company’s data is right.

Yes! In addition to your dedicated Paycom specialist, any tax registration, agency notices or other important tax info goes straight to our tax experts after you upload them through Client Action Center. If you need to follow up on any tax issue, you can easily contact your specialist with one tap.

Client Action Center lets you easily upload any tax agency notice you receive. From there, that notice flows directly to our tax specialists for review, research and resolution. Meanwhile, you can easily check the status of your request at any time.

Yes! Client Action Center automatically notifies you of any missing information, such as tax IDs and tax rates. If you’re ever unsure about a notification, you can easily contact your dedicated Paycom specialist right from Client Action Center using our mobile app.

Client Action Center provides extensive tax information through an easy-to-use dashboard, including:

- tax accounts

- tax profiles and any discrepancies

- pending and missing account numbers

- tax rates for paid family leave, disability and SUTA

- and more

The tax profile discrepancy report compares an employee's currently assigned tax profile to the tax profile generated by Paycom based on the employee's home address and work address. It automatically highlights discrepancies so you can quickly update that employee’s tax profile with correct information right from Client Action Center.

If a client has an employee who has a tax profile discrepancy, a notification will appear in Client Action Center. This gives you greater, early visibility into potential issues and helps you avoid prior period adjustments.

Client Action Center’s tax center dashboard tracks any issues that need attention, including current prior period adjustments. You also can easily monitor the status of open issues and upload attachments as needed to help ensure we have all the information needed to resolve prior period adjustments. Historical information displays in the tax center dashboard, and wire transfer information is available in the banking section of Client Action Center.

Yes. When reviewing a tax profile discrepancy, you can default to your remote employee’s home address for geolocation of taxes.