Government and Compliance

Reduce your risk of audits, penalties and time-consuming work

What it does

Take complexity out of compliance

Unchecked regulatory issues grind your business to a halt and pile more on top of your workload. But trying to stay ahead of employment laws can also feel like spinning plates. Or it could, without our HR compliance software.

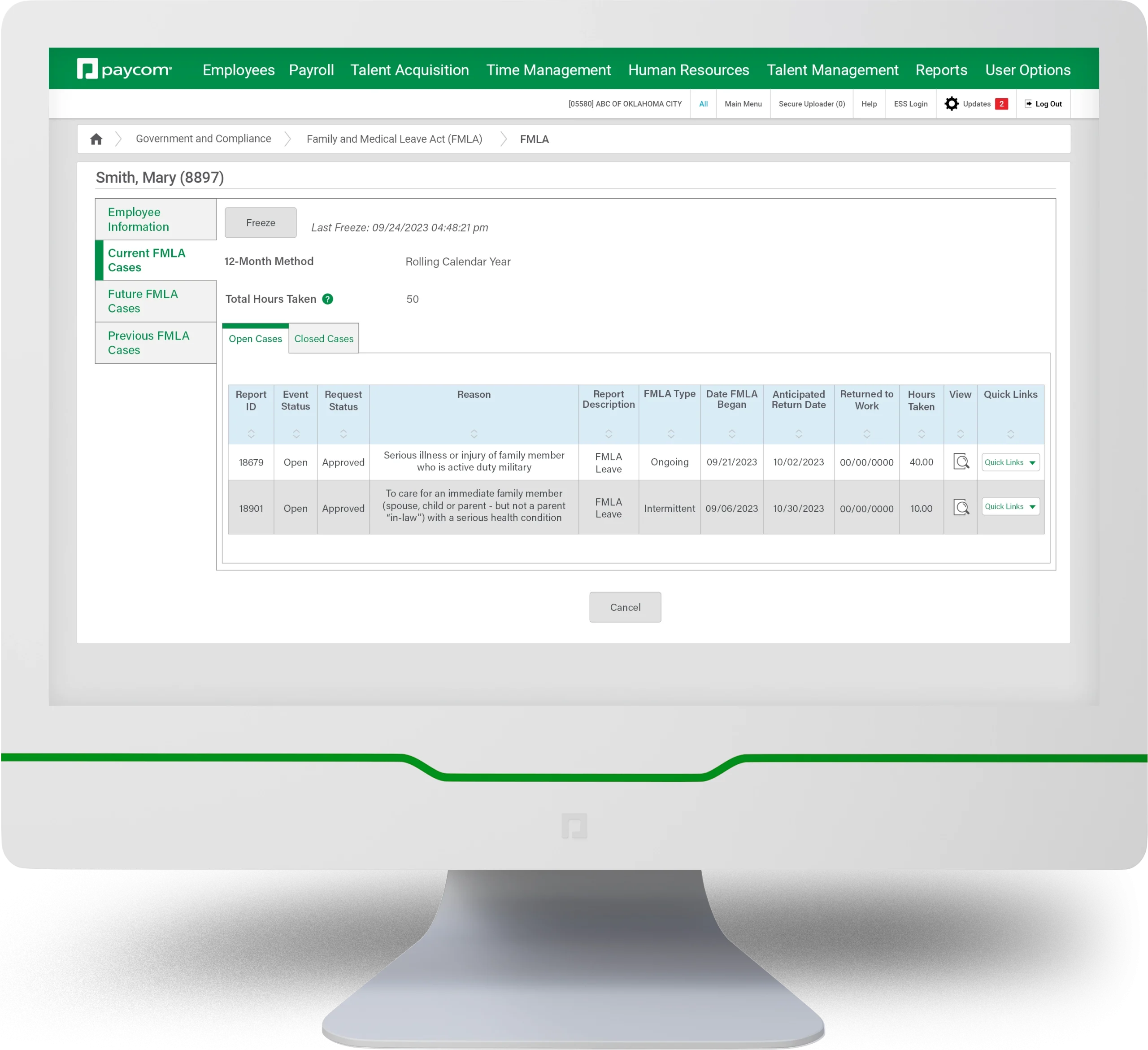

Our Government and Compliance tool makes protecting your organization easier by:

- giving you insight into FLSA data, employee leave, unemployment claims and more

- generating reports in government-required formats

- reminding you of employee leave statuses

- offering one convenient place for leave and accommodations case management

- tracking COBRA reasons, payment history, unemployment claims and dates for former employees

- generating and displaying records of employment and filing information

- simplifying payroll-based journal reporting

- providing an FLSA toolkit to create and prepare labor-cost scenarios

Full-solution Automation

Less liability, no manual tasks

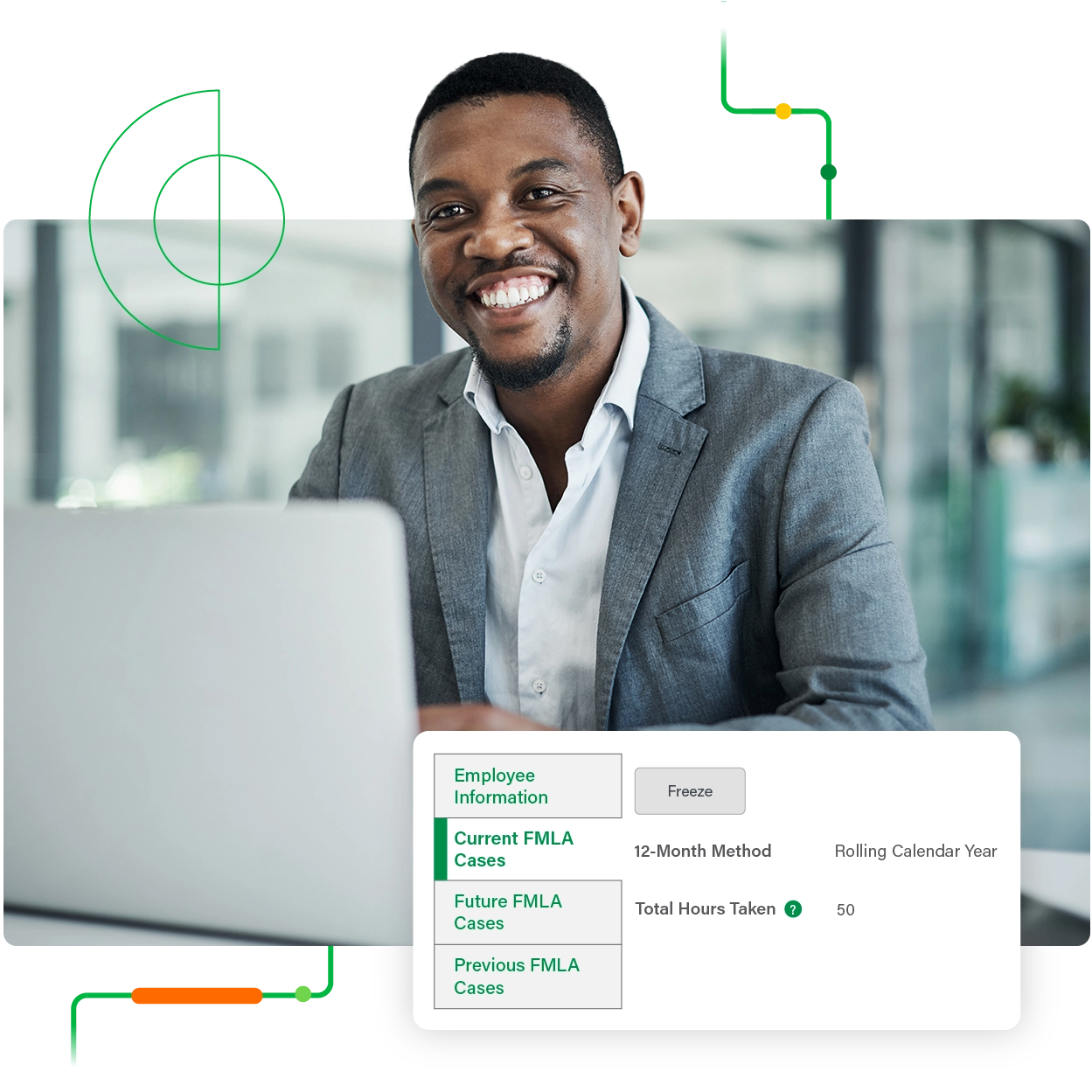

As you work to shield your organization from audits, violations and other penalties, your HR compliance software should work for you. Our automated tech exists in our truly single software, so you don’t need to reenter data or log into separate systems to shore up compliance. Plus, Government and Compliance lightens your workload by automatically sending you:

- recurring, correctly formatted reports when you need them (after a simple setup through our Push Reporting® tool)

- notifications about employee leave, workplace injuries and illnesses, and missing compliance data

See what people are saying about Government and Compliance

Comprehensive reporting

A report for every compliance hurdle

You can’t comply with confidence without insight. Luckily, our HR compliance software uses real-time employee data to create truly comprehensive reports. All you do is confirm the report you need, and our tech handles the rest.

Instantly run reports on:

- Fair Labor Standards Act

- Family and Medical Leave Act

- Equal Employment Opportunity Commission EEO-1

- Occupational Safety and Health Administration 300, 300-A and 301

- Veterans' Employment and Training Service 4212

- California pay data

- payroll-based journal

- and more

Frequently Asked Questions

Learn more about HR compliance

HR and government compliance software helps organizations stay up to date with any regulations or compliance laws they must follow. By empowering HR teams to automate and manage their necessary compliance tasks, the right software helps reduce risk and increase audit-readiness.

Paycom’s government compliance software gives real-time insight with comprehensive reporting, automated notifications and case management functionality. With a detailed view into everything compliance, an organization is better equipped to reduce its exposure to violations, audits and penalties.

Reports in Paycom’s government compliance software include EEO-1, VETS-4212, OSHA 300 log, OSHA 300-A, FLSA earnings and absences, certified payroll, payroll-based journal and more.

Paycom provides frequent updates about legislative and regulatory changes that directly impact our clients’ businesses.

Paycom automatically sends HR the recurring reports they need in the correct format and notifies them — and all other necessary parties you specify — about leave management actions, workplace injury and illness incidents, and compliance tracking. Plus, they can view all the information they need all in one place, so there’s no more searching for the right report or switching between platforms.

Both on- and off-site, our comprehensive security standards and technologies are formally audited and verified for compliance annually. As one of the few payroll processors to be ISO 27001, ISO 27701, ISO 9001, ISO 22301, SOC 1 and SOC 2-certified, we take precautions to protect and secure your data as if it were our own. You can read our security standards in full here.

Learn more about Paycom