Enhanced ACA

Easy-to-use software to help you ace ACA reporting

What it does

Take the pain out of ACA compliance

The Affordable Care Act is complex, sure. But that doesn’t mean complying with its high-stakes requirements should cost you sleep. Our ACA software lightens your load with detailed reporting, a real-time dashboard and automated filings to help you easily navigate this ever-changing law year-round.

File with ease

Tired of juggling constant deadlines? Enhanced ACA automates and streamlines applicable state, federal and end-of-year filings while creating a clear audit trail. Meanwhile, you simply oversee compliance, not race to maintain it.

Drill into the details

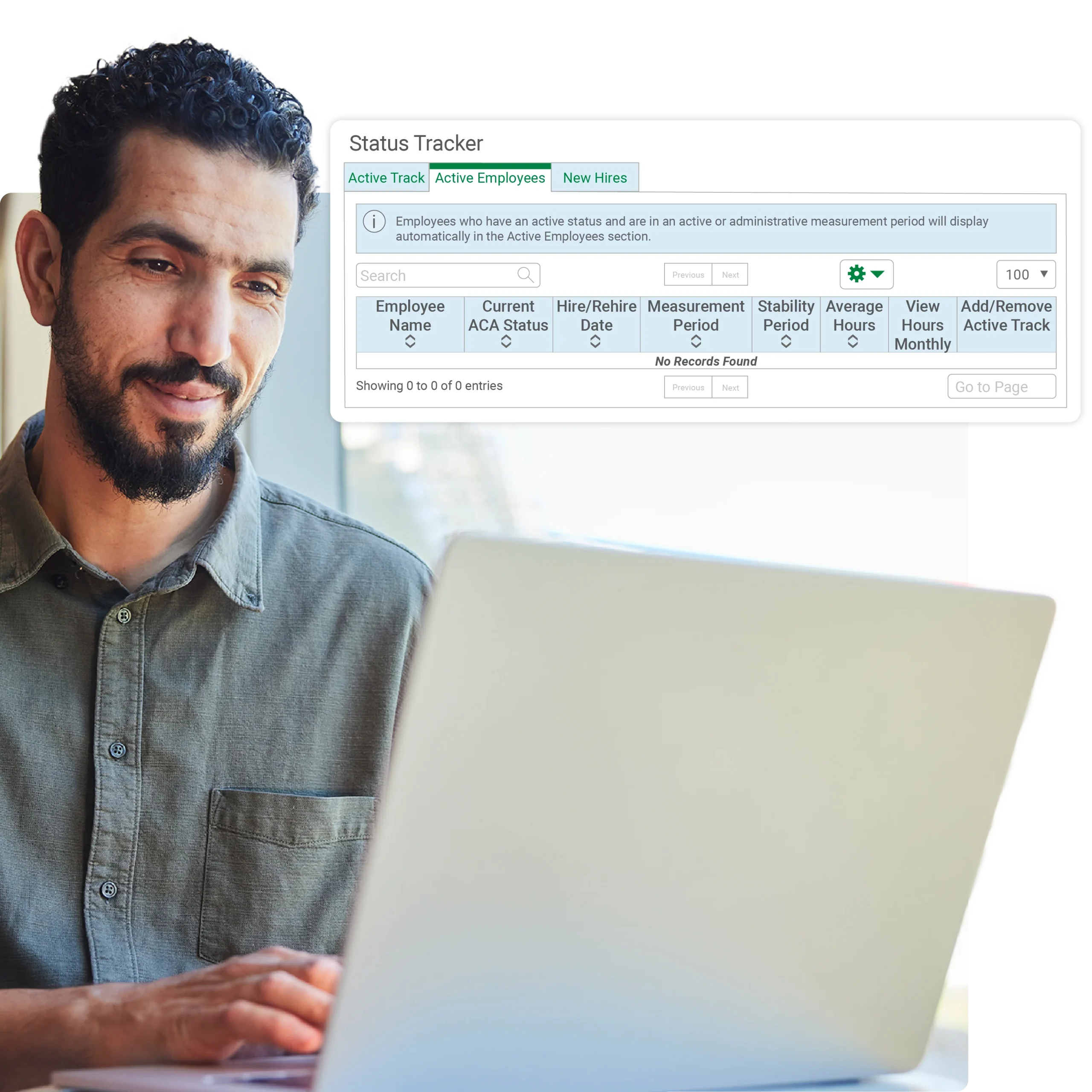

Since Enhanced ACA exists in our single software, you benefit from quick and detailed reports backed by the most up-to-date workforce data. Easily track your employees’ statuses so you know the coverage you’re required to offer them.

Give employees insight

While we help ensure your organization offers fair and compliant benefits to qualifying employees, your people gain much-needed visibility into affordable benefits.

How it works

The easiest way to follow ACA

Ready to ease your compliance burden? Our truly single software and full-solution automation help make ACA reporting a convenient part of your role, not an endless hassle.

Your one-stop shop

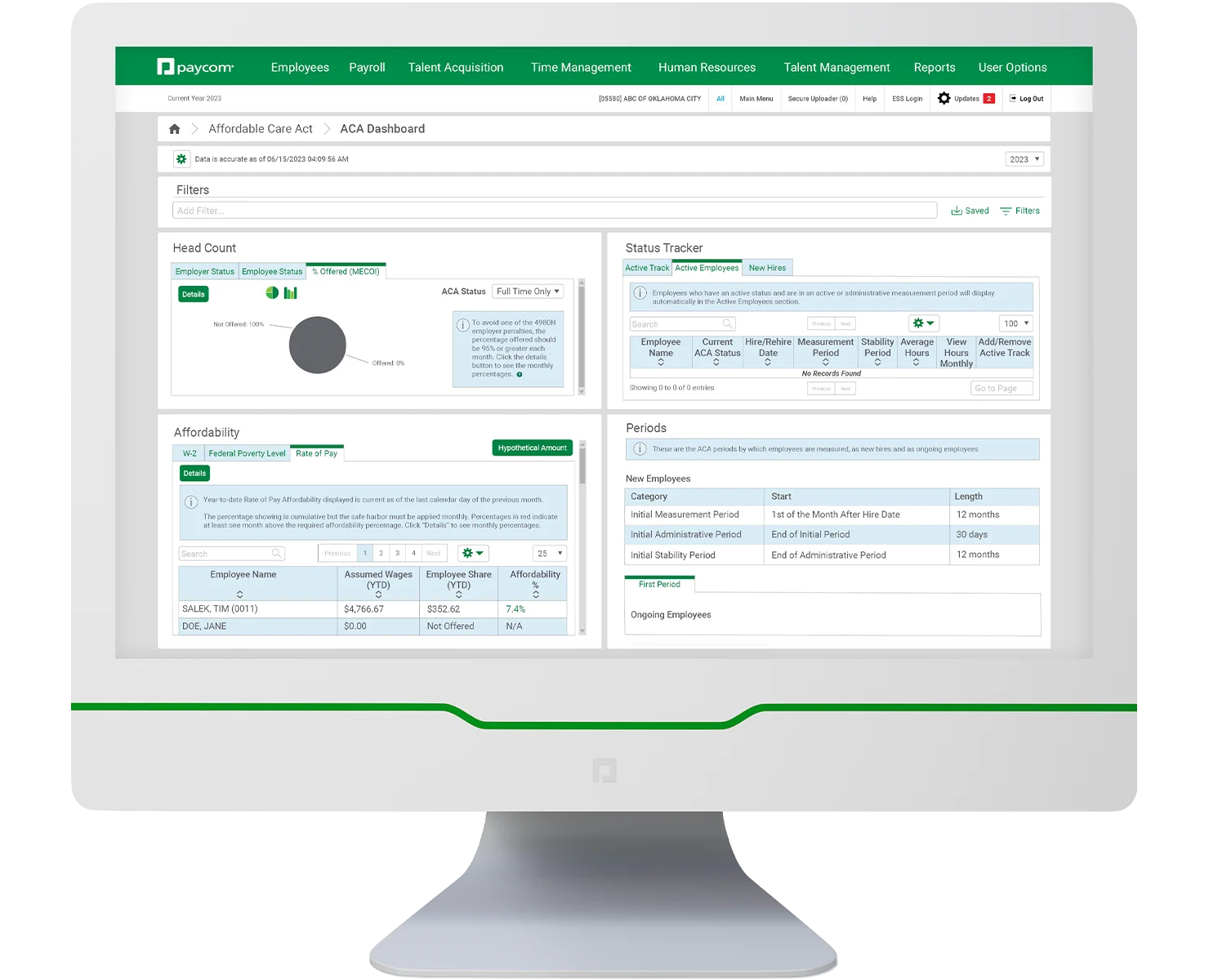

Our ACA Dashboard gives you direct insight into all aspects of ACA compliance, including head count, hours worked, plan affordability, employee qualifying statuses for benefits and measurement period details.

No more blind spots

Worried about missing data? Our ACA Checklist actively monitors your company’s info to ensure employer and employee data alike is accurate and available.

No fussing over forms

Ditch manually filing forms. We’ll file Forms 1094-B and -C or 1095-B and -C with the IRS on your behalf. With our Time and Attendance and Benefits Administration tools, it won’t require any extra work from you.

Get the jump on compliance

Proactive notifications help you avoid unexpected penalties by alerting you of closing measurement periods, part-time employees approaching full time and when your org nears applicable large employer status.

Automatic reports

Never let a change catch you off guard. Our ACA reporting software automatically creates monthly reports to alert you of ACA status changes, employees’ trending hours, factors affecting coverage and more.

Take no chances

Your org’s compliance can’t rely on guesswork. Our tech makes it easy for you to test premium affordability for all three safe harbor codes, so you can choose the best plan for you and your employees.

Your one-stop shop

Our ACA Dashboard gives you direct insight into all aspects of ACA compliance, including head count, hours worked, plan affordability, employee qualifying statuses for benefits and measurement period details.

Get the jump on compliance

Proactive notifications help you avoid unexpected penalties by alerting you of closing measurement periods, part-time employees approaching full time and when your org nears applicable large employer status.

No more blind spots

Worried about missing data? Our ACA Checklist actively monitors your company’s info to ensure employer and employee data alike is accurate and available.

Automatic reports

Never let a change catch you off guard. Our ACA reporting software automatically creates monthly reports to alert you of ACA status changes, employees’ trending hours, factors affecting coverage and more.

No fussing over forms

Ditch manually filing forms. We’ll file Forms 1094-B and -C or 1095-B and -C with the IRS on your behalf. With our Time and Attendance and Benefits Administration tools, it won’t require any extra work from you.

Take no chances

Your org’s compliance can’t rely on guesswork. Our tech makes it easy for you to test premium affordability for all three safe harbor codes, so you can choose the best plan for you and your employees.

See what people are saying about enhanced aca

Comprehensive convenience

Enhanced ACA seamlessly connects with

Data from our Benefits Administration tech flows seamlessly into our ACA reporting software to automatically track plan affordability.

Our Time and Attendance tool seamlessly sends data about employee hours — like those who approach full-time status — to Enhanced ACA for real-time reports.

Our HR reporting software lets you easily generate reports on hours worked, labor management and any other metric to help inform your compliance strategy.

Frequently asked questions

Learn more about ACA compliance

ACA compliance software is technology that helps employers adhere to the requirement of the Affordable Care Act (ACA). ACA compliance software can support this effort in several ways, such as automatically populating important documents like Forms 1094 and 1095. Certain software may also notify organizations of when they have enough full-time employees (or the equivalent number of hours worked) to qualify as an applicable large employer.

ACA software helps employers alleviate their compliance burden and avoid penalties. Rather than manually verifying if their organization needs to offer specific plan options, ACA software can help determine if they should. This tech can also help HR:

- stay aware of filing deadlines

- respond to audits

- file with the IRS

- make informed decisions about the company’s health care offerings

Our Enhanced ACA tool automatically generates reports covering every relevant metric for ACA compliance, like:

- head count

- hours worked

- plan affordability

- measurement period details

- and more

Paycom also takes the burden of filing off your plate, since we can automatically populate necessary forms and file them with the IRS. Plus, since our ACA reporting tech exists in Paycom’s single software, you don’t need to reenter data employees already provided.

We electronically file Forms 1094-B and -C or 1095-B and-C. The specific document(s) used will depend on your organization’s unique needs.

With Enhanced ACA’s automation alongside our Benefits Administration and Time and Attendance tools, Paycom updates employee data used for ACA compliance in real time so monthly reporting is a breeze. Plus, we make it easy for you to offer strategic insights for financial planning, audit preparedness and year-end filing.

Yes! For example, our software will automatically alert you when your company approaches the applicable large employer status. And our automated monthly reports make it easy to determine where your company stands with ACA and if you need to reevaluate your benefits packages.

Our ACA reporting software lets you easily generate reports on:

- ACA status changes

- employees’ ACA trending hours

- coverage affordability

- coverage percent offered

- applicable large employer trends*

*To automate this report, employers must also have Paycom’s Time and Attendance tool.

Yes. Employees may conveniently access a digital copy of their Form 1095-C through Paycom’s mobile app. We’ll also mail a physical 1095-C to your employees’ preferred mailing address.

Yes! With our Enhanced ACA tool, Paycom completes filings in applicable U.S. states and districts (California, Massachusetts, New Jersey, Rhode Island and Washington, D.C.).